Some handy tips to help you manage the ‘App tax‘ as a short-term accommodation provider.

You’ve likely heard that there are changes coming with GST for short-term accommodation providers from 1 April 2024 – this Easter Monday.

With many small scale short-term accommodation providers on the island we decided to put together some handy tips to help you manage these changes with information sourced from the experts like PWC, KPMG and Beany, to help you avoid burying your head in the sand.

The new rules apply to bookings made through apps and booking platforms such as Airbnb and Booking.com. The rules do not apply to bookings made directly to you, for example, through your own website or through a listing only platform (like, greatbarrier.co.nz or aucklandnz.com).

All short-stay accommodation booked through an online platform will attract GST at 15%, regardless of whether or not you (the underlying supplier) are GST registered.

The platform operator will be the one responsible for paying the GST to Inland Revenue and issuing taxable invoices to the customer. However, there are different things you need to do as a supplier, depending on if you are GST registered or not.

Here’s a quick run through:

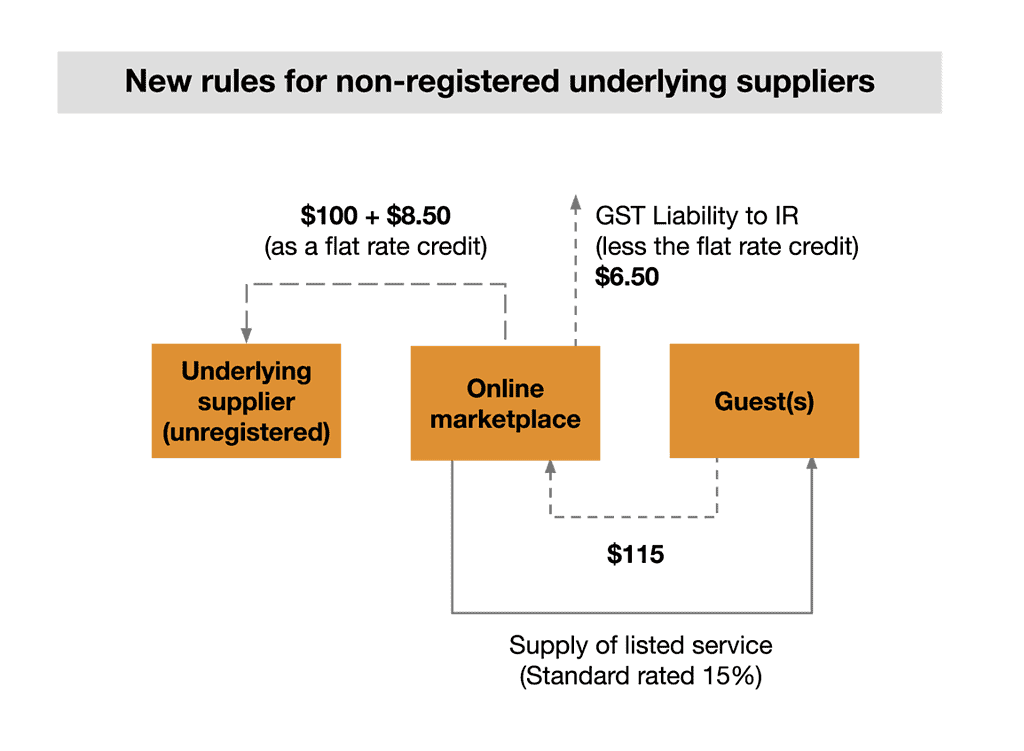

Not GST Registered?

If you are not registered, you do not need to account for the GST, the platform does this and pays it to the IRD. You will receive a ‘flat rate credit’ of 8.5% of the GST exclusive price of your accommodation from the platform. The flat rate credit acts as a compensation to non GST registered providers who cannot claim GST on expenses.

The flat rate credit, is 8.5% of all the services you sell and supply through the platform, like cleaning.

Don’t forget, you’ll still need to monitor whether you reach the GST reg threshold – $60k. If you do, you’ll need to register for GST and ensure you notify the booking platform. If you are sitting on the edge of the threshold, it’s best to contact a qualified accountant who can advise you on what is best with regards to GST registration.

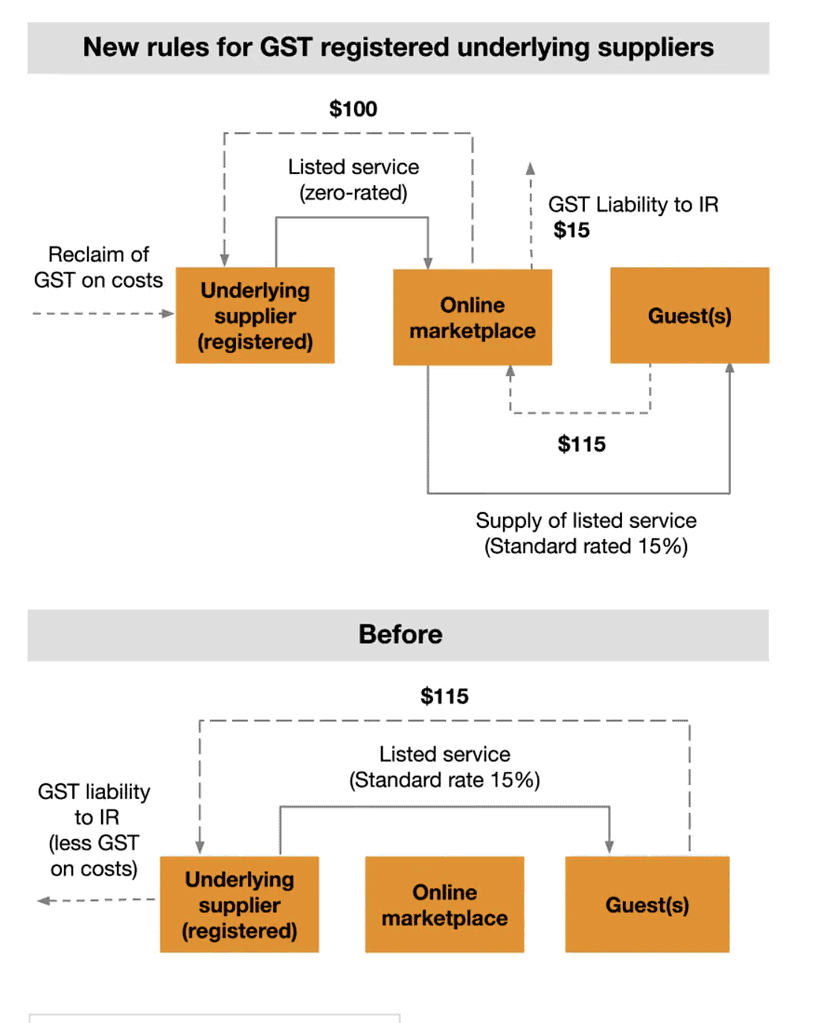

GST registered?

You need to ensure booking platforms are aware that you are GST registered, but you will no longer account for GST on 15% on your accommodation booked through the platform as you have done previously.

You’ll need to report this income as xero-rated on your GST return. The platform will now issue tax invoices to the customer – you don’t need to. As a supplier you can still claim GST on your costs, but will not receive the 8.5% flat rate tax credit back like non GST registered suppliers.

Using a property manager? The rules are a bit different.

If you are using an intermediary, like a property manager, the rules are different again. This listing intermediary needs to contact the platform and will be passing on the 8.5% flat rate credit to their non GST registered property owners. Get in touch with your intermediary and check you both have the same understanding about these new rules.

What about your nightly rates?

You’ll need to find out how the platform has decided to manage this, to make an informed decision on your price points. There are no mandatory laws of how they have to manage this.

Airbnb, for example, are opting to increase all nightly rates by 15% across the board, so technically for all non-GST registered suppliers, what goes in your pocket will increase by 8.5%. You might like to consider this in terms of pricing your accommodation competitively. Booking.com have also put together an extensive guide on how to manage the change with their platform specifically here.

The government have also given each platform flexibility in how they manage existing bookings over the crossover period, or for bookings made before 1 April 2024, for dates after the news rules kick in, get ahead and check with your booking platform how they are managing this to avoid missing out on any revenue.

Words by Aotea Advocate

Other useful resources:

Auckland Airbnb Host Community – Sharing useful resources on running and managing airbnb’s in Auckland

‘Important GST changes for NZ short stay/visitor accommodation providers‘ – PwC

General information about short term accommodation income and GST from Beany

Disclaimer: This article offers general information on these App tax GST changes and should not be seen as professional advice. Always consult with a qualified professional for your specific needs

[…] this April. All online accommodation bookings, regardless of the host’s annual turnover, will now carry a 15% Goods and Services Tax. This change sweeps across platforms such as Airbnb, Bookabach, and Booking.com, ending the […]